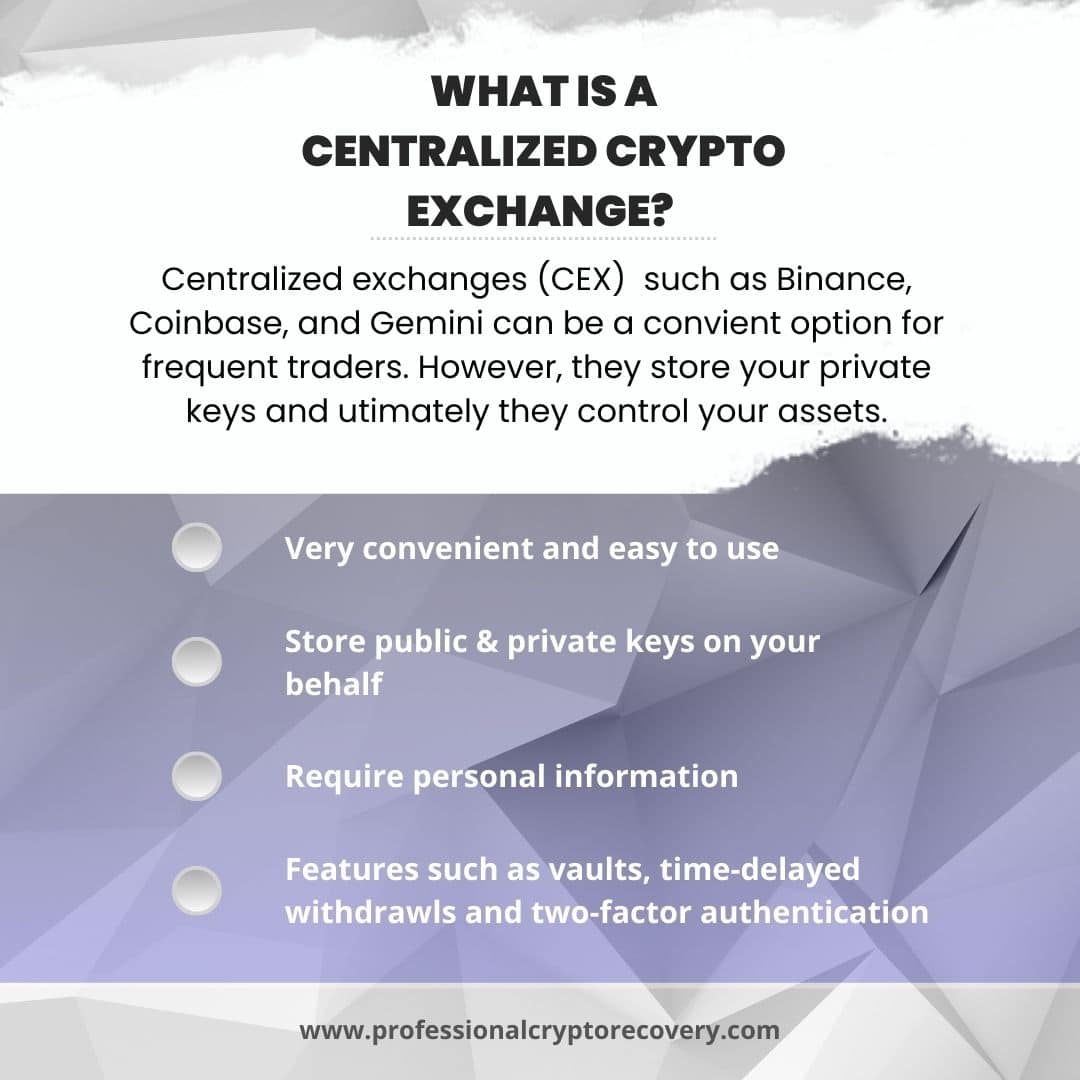

Did you know that while primarily advertised as cryptocurrency trading and investment platforms, centralized exchanges (CEXs) also double as storage solutions? Today, millions of people around the world hold their crypto assets on Binance, Coinbase, Gemini, and other exchanges.

This article will explore CEXs as a crypto storage solution. It will look at how CEX wallets work compared to wallets like Metamask, Trust Wallet, Ledger, etc., why people chose them, as well as why many in the crypto community consider them to be a bad idea.

How Do CEX Wallets Work?

To understand how CEX wallets work, you must first understand how crypto wallets work. This is because CEX wallets, at least the type you interact with as a user, are not actually wallets. They are accounts.

How Crypto Wallets Work

A real crypto wallet doesn’t actually store crypto. Instead, it stores two cryptographically linked keys; public and private keys.

Private keys are a wallet’s digital signature. They prove ownership of the wallet and thus, are used to sign transactions. Public keys, on the other hand, are a wallet’s public address on the blockchain. This is where people send crypto assets.

The crypto itself lives on the blockchain as bits of data. Each bit of data, in turn, has a public address which it is associated with. And each wallet lets you access the bits of data associated with its public address. This is how people manage their crypto balances.

How CEX Accounts Work

When you join a platform like Binance, you do so by creating an account. You can then buy crypto with fiat to store in your account and/or deposit crypto from another source. You’ll be able to read your crypto balance, trade, and conduct transactions from your account.

But since it’s an account, it doesn’t store your public and private keys. These are, instead, stored in actual crypto wallets controlled by the centralized exchange.

From this information, you can see how holding crypto in a CEX works; the exchange has crypto wallets it keeps user funds in. Some of these are hot wallets and others are cold wallets. It then lets users create accounts, from which they access and manage their funds.

In all this, the platform retains control of the private keys. So by depositing crypto in an exchange, you’re depositing it in wallets owned by the platform. You’re essentially giving your crypto to the platform to store on your behalf.

This is why CEX wallets are referred to as custodial wallets. You give up direct custody and control of your funds to someone else, although you can still access and manage them via an account.

Platforms like Metamask and Trustwallet are wallets in the technical sense. They store their private and public keys and give out a seed phrase. This is a phrase consisting of 12-24 randomly generated words that can be used to generate the wallet’s public and private keys.

So, by using any of these wallets you retain control of your private keys. This gives you direct control of your assets on the blockchain. Because of this, such wallets are known as non-custodial wallets.

Features of Custodial Wallets

Many custodial wallets share the following features:

- When opening your account, you’ll be required to provide some personal information for KYC purposes. This includes your real name, a picture of your face, and a picture of your ID or driver’s license.

- You’ll also have to set a password for security purposes. Make sure you create a strong and unique password to prevent unauthorized access.

- You can also enable two-factor authentication (2FA) to add an extra layer of security. This feature requires you to enter a code (sent via SMS to your phone number) in addition to your password when logging in.

Another way to enable 2FA is to use an authenticator app. This is an app that generates time-based security codes that you’ll need to enter together with your password in order to log in.

- Some custodial wallets let you create vaults. These are meant to be more secure than standard accounts as they typically require multiple approvals before funds are withdrawn.

- There are also time-delayed withdrawals. When enabled, this feature requires the user to wait a certain amount of time after requesting a withdrawal before their request is processed. The idea here is that if there is an unauthorized withdrawal, the user will have time to cancel it.

Why People Use Custodial CEX Wallets

You’d think few people would tolerate the idea of surrendering control of their crypto to someone else. But all around the world, millions of people have done it and many more will do it in the coming years.

Why?

One word; convenience. The initial process of opening an account may be a little tedious due to KYC requirements, but past that, CEX wallets come with a lot of convenience.

For example, keeping your seed phrase safe is a huge responsibility. If it falls into the wrong hands, your funds could be drained, and if you lose it, you might end up losing access to your crypto forever.

Exchange wallets don’t place this responsibility on the user. The crypto exchange assumes the responsibility of securing your keys. So, you don’t have to worry about losing or securing your seed phrase. Your only duty is to set a password, which if you lose, you can easily reset via email. In contrast, there is no way of recovering your seed phrase once you lose it.

There is also a lot of convenience when it comes to trading. CEX wallets are typically built as part of a large trading platform. This means you can easily trade cryptocurrencies. You can also purchase/sell crypto with/for fiat.

So generally, people who use custodial CEX wallets are those who:

- Don’t want to take on the huge responsibility of securing their seed phrase and private keys

- Regularly trade cryptocurrencies

- Regularly buy or sell crypto assets for fiat

Still, a good number of people are unconvinced about custodial wallets. There is a good reason behind this, as explained by the phrase “not your keys, not your crypto.”

What Does “Not Your Keys, Not Your Crypto” Mean?

Custodial wallets, while convenient, carry a good amount of counter-party risk. This is because by giving someone else custody of your crypto you can lose it through no fault of your own.

There are several ways that this can happen:

- The exchange is hacked

The platform stores your funds and those of millions of other users in its own crypto wallets. That is billions of dollars worth of crypto. This makes them an attractive target for hackers. If any of these hacks succeeds and is big enough to collapse the platform, you stand to lose all your funds.

Today, there is little chance of this happening. But in the early years of crypto, users lost hundreds of millions of dollars to such hacks. The most infamous of these is the Mt. Gox hack of 2014, where 850,000 BTC (worth about $473 million at the time) in user funds was stolen.

- Mismanagement causes the CEX to collapse

Storing your crypto on a custodial wallet usually gives the platform and its management power to do whatever they want with your money. Many platforms take advantage of this to conduct very risky deals and investments in pursuit of bigger profits, which won’t be shared with the user.

Often, these moves go wrong and money is lost. If they involve a sufficiently large amount of money, the platform may collapse. A very recent example is FTX, which was one of the largest crypto exchanges at the time of its collapse. Gross mismanagement of the CEX caused users to lose access to billions.

Usually, when an exchange collapses due to a hack or funds mismanagement, it pauses withdrawals because it no longer has the funds that users are requesting to withdraw. This is how users lose access to their funds.

Unless the platform finds a way to recover the funds, the loss is often total and permanent. This is because the FDIC does not insure crypto assets held by financial institutions. It is up to the platform to refund users.

If the crypto really belonged to the user, they would still have access to their assets. But because they gave up control of their private keys, they essentially gave the platform control over their crypto, which put them in a position to lose their crypto. This is the rationale behind the phrase “not your keys, not your crypto.”

Are Exchange Wallets Any Good?

Ultimately, it depends on your needs. If you’re someone who trades often or is new to crypto and not quite ready to manage your own private keys, and you’re willing to assume the counterparty risk that comes with this decision, choosing an exchange wallet isn’t a bad idea. This type of wallet comes with many trading and security features that should serve you well.