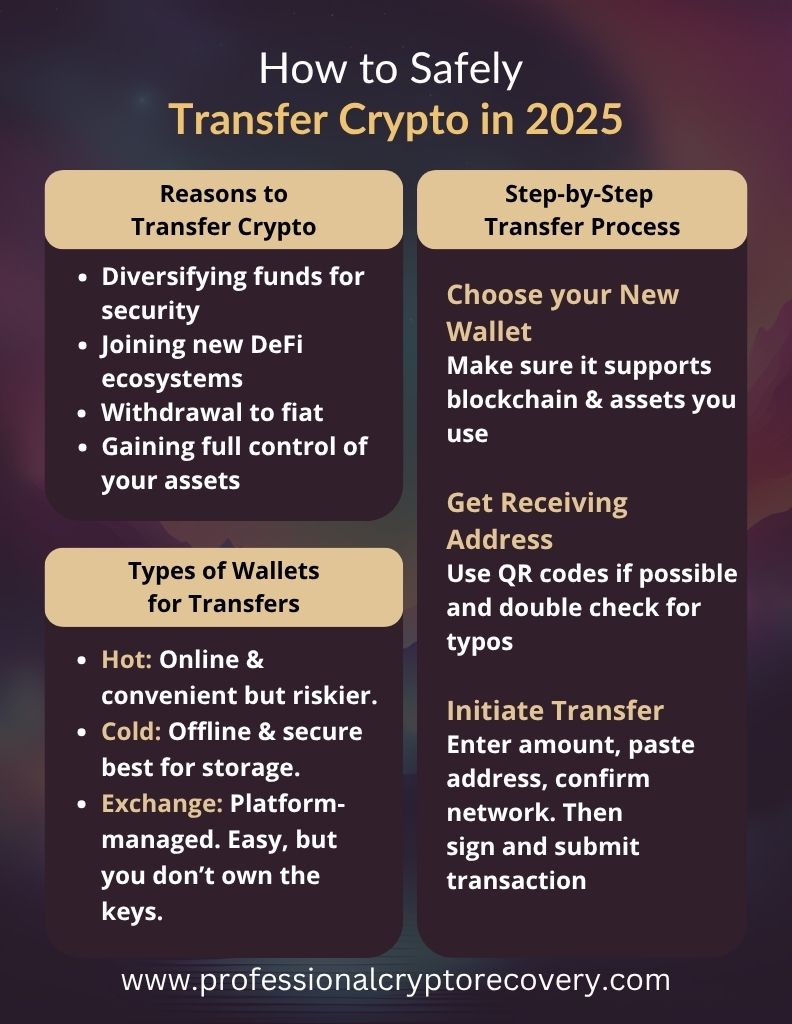

Sometimes you have to transfer crypto between wallets. Maybe you’re switching to a new wallet entirely, want to store your assets in multiple wallets for safety, or are pursuing opportunities in different decentralized finance (DeFi) ecosystems. Whatever your reason, do it safely.

Because crypto transactions are irreversible, a minor mistake could cause your assets to join an unfortunate user-error club that loses tens of millions of dollars every year. We don’t want you to be in that club. Here’s how you can stay out of it.

Types of Crypto Wallets

Before we get to transferring assets, it’s a good idea to highlight the different types of crypto wallets. How you transfer your assets depends heavily on where they’re stored.

- Hot wallets are connected to the internet. These are mobile apps and browser extensions, such as Trust Wallet and Blockchain.com. They offer ease of use and fast access, making them ideal for day-to-day transactions and interacting with dApps. But because they’re always online, they’re more exposed to risks like phishing and malware.

- Cold wallets are offline by default. These include hardware wallets like Ledger and Trezor, paper wallets, and air-gapped devices. They’re considered the most secure for long-term storage, as private keys never touch the internet. Transfers from cold wallets require additional steps, such as physically connecting the device and manually signing transactions.

- Exchange wallets are custodial wallets managed by centralized platforms like Binance, Coinbase, or Kraken. Users don’t control the private keys; instead, the exchange manages wallet infrastructure on their behalf. These wallets are useful for quick trades and onboarding, but they carry custodial risk.

The type of wallet directly impacts how transfers are handled. For example, moving funds from a hardware wallet takes longer but offers greater security. Transfers to or from exchanges may involve additional waiting periods or network confirmation. Knowing your wallet type helps you take the right precautions at each step.

Risks Involved When Transferring Crypto Between Wallets

Transferring assets may seem straightforward, but it is one of the most error-prone processes in crypto. Not even the biggest, most resourceful organizations are safe. Take Crypto.com, for instance. In 2022, the exchange accidentally transferred $10.5m to the wrong destination and didn’t notice for months.

Here are some risks to watch out for when transferring crypto between wallets.

1. Sending to the Wrong Address

Crypto transactions are final. If you send crypto to the wrong address, your funds are likely lost forever unless the recipient returns them voluntarily. Typos, copy/paste errors, or malware altering the clipboard can all cause this.

2. Wrong Network Selection

Many tokens exist on multiple blockchains (e.g., USDT on Ethereum, BNB Chain, and Tron). Sending a token to the wrong network can result in funds being stuck or permanently lost if the destination wallet doesn’t support that network.

Sometimes funds can be recovered with the help of a specialist. And if the destination wallet was an exchange, the exchange may support that network in the future, allowing you to access them again.

3. Gas Fees and Network Congestion

Every blockchain charges a transaction fee. If you manually set the fee too low, your transaction might get stuck or dropped. During periods of high congestion, fees can spike suddenly, especially on networks like Ethereum, which can delay transactions.

4. Phishing and Malware

Hackers are everywhere. Fake wallet interfaces, malicious browser extensions, and phishing websites are used to trick users into authorizing transfers to an attacker’s address. Clipboard hijackers silently replace wallet addresses when pasted.

5. Compatibility Issues

Not all wallets support every token or blockchain. Sending unsupported tokens to a wallet can result in inaccessible funds. Always verify compatibility before transferring.

6. Device or Connection Vulnerabilities

Transferring from a compromised device or over insecure Wi-Fi can expose your transaction details or private keys to attackers.

7. Human Error in Manual Processes

Cold wallet users often need to manually input data or scan QR codes. Any small mistake, like scanning the wrong code or entering an incorrect amount, can cause issues.

8. Custodial Risk (for Exchange Transfers)

When transferring to or from an exchange wallet, you’re relying on the platform to process the withdrawal or deposit correctly. Downtime, delays, or account restrictions can temporarily block access.

How to Migrate Crypto Wallets

Transferring assets between wallets is pretty straightforward. But if you want a hitchless experience, you need to be aware of some important considerations.

Choose Your New Wallet

First, identify the wallet you want to transfer your crypto to. It can always be the same wallet brand you’re already using, but installed on a different device with new addresses and accounts. But if you’re moving between different brands, your choice will also be influenced by your reasons for wanting the transfer.

- If you’re doing it to spread out your funds: You only have to find a target wallet that supports your asset type. So, if you have a Bitcoin wallet, say Electrum, find another Bitcoin wallet, like Sparrow. This is also the case if you’re switching to a new wallet entirely, maybe because your older wallet was discontinued, such as Jaxx Liberty, BTC.com, or Toast.

- You’re switching chains: Your new wallet must support both the target blockchain and the assets you’re transferring. If you’re dealing with EVM-compatible blockchains, like Ethereum and BNB Smart Chain (BSC), this should be relatively easy, as many ERC-20 wallets support the same chains and assets. Moving assets from Bitcoin to Ethereum, or vice versa, is a bit more complicated, as you have to consider wrapped assets.

- You want to withdraw your assets: If you have assets in a non-custodial wallet and want to withdraw them as fiat currency, you’ll have to move them to a custodial wallet. Non-custodial wallets don’t offer fiat-to-crypto trading because of their know-your-customer (KYC) requirements. So, platforms like Kraken, Coinbase, and Binance are your only options.

- You want full control of your assets: If you have your crypto in a custodial wallet but desire full control, your best option is to move it to a non-custodial platform. Make sure that the new wallet supports the assets you’re moving.

Get the Receiving Address and Initiate a Transfer

In your older wallet, look for the option to send crypto to another address. It should lead you to a screen where you are required to provide the receiving address. To find this address, go to your new wallet and look for the option to receive crypto. That option should reveal the address that you can then copy into the sending wallet.

You have to be careful during this part of the process. This is where a catastrophic mistake can easily happen, i.e., you mistype the receiving address and end up sending money to a different wallet altogether. To avoid that mistake, try copying and pasting the address if possible, rather than manually typing it into the sending wallet.

Wallet developers are also aware of how risky this process can be. So, to make things easier, many modern wallets include a QR code version of their address and can read other wallets’ QR code addresses. All you have to do is scan the receiving address, and the software will handle the rest.

Once you’ve provided the correct address, enter the amount of crypto you want to transfer and sign off on the transaction. Now, you only need to wait for the blockchain to confirm the transfer, which, depending on the network, may take a couple of minutes or more.

Special Considerations

Not every wallet transfer follows the process above. There might be some additional steps and special considerations to make, depending on what you’re trying to do. We’ll look at two scenarios: moving between blockchains via a bridge and transferring to and from a custodial platform.

Transferring Via a Bridge

Decentralized finance has been a valuable development in crypto, bringing many opportunities and innovations on-chain. But it’s only possible on smart-contract platforms like Ethereum, Solana, and BSC. Bitcoin users who want to participate in DeFi must move their assets to these platforms.

That doesn’t necessarily mean selling BTC for an ERC-20 asset. There are BTC-centered opportunities in DeFi as well, despite Bitcoin not being an ERC-20 asset. The magic happens via products called “wrapped assets”.

As you move your BTC to a DeFi wallet like Metamask, you have to convert it to a wrapped version (wBTC or cbBTC) that can exist on the target blockchain.

That is where bridges come in. The protocols enable transferring assets from one blockchain to another by wrapping them. If you’re trying to get your BTC from your BTC wallet to a DeFi wallet, you must first pass it through a crypto bridge. Attempting to transfer the assets directly might result in a permanent loss of funds.

Transferring to a Custodial Wallet

Custodial wallets are crypto exchanges like Binance, Gemini, and Coinbase. Here, you can store different assets on the same platform. However, transferring assets to the wallet needs some care.

Despite being on the same platform, assets tend to have different receiving addresses depending on the underlying protocol. Let’s say you want to transfer some BTC and some ETH to your exchange wallet for trading or withdrawal. There is no shared receiving address to which both assets can be sent.

Before your exchange wallet gives you an address to send crypto to, you’ll have to specify the asset you’re receiving as well as the blockchain you’re sending it to. This influences the addresses the platform generates, so BTC and ETH will have different addresses even though the funds are going to the same account.

Initiating a transaction to an address designated to a different asset may result in permanent loss of funds.

Some tokens (XRP and XLM) also use a shared address model on exchanges, i.e., a single address to receive deposits from all users. So, to identify the intended destination, sending such assets to an exchange requires including a memo.

A memo is a unique number that identifies which user’s account the deposit belongs to. Without it, the exchange receives your assets but doesn’t know who to send them to, so your funds won’t be credited automatically. Some exchanges allow manual recovery of such transactions, but it’s a slow and sometimes risky process.

Precautions When Transferring Crypto Between Wallets

It’s easy to transfer crypto between wallets, but just as risky. Crypto transactions cannot be reversed, and with different tokens, blockchains, and wallets adhering to different standards, a minor mistake can result in losing your assets.

There are precautions you can take to ensure your transfer goes smoothly, starting with double-checking the receiving address before sending funds. If possible, use QR codes, which eliminate the risk of typographical mistakes in the destination address.

It’s also important to perform transfers on a secure device with up-to-date antivirus software and to avoid public Wi-Fi networks. The risk of malware (such as clipboard hijackers) is greatly reduced by using a clean system and a secure internet connection.

If you do all this, you should be able to safely transfer crypto between wallets. In the event of any issues with your new wallet, such as a partial seed phrase or damaged backup files, Professional Crypto Recovery can provide a solution.

We have extensive experience in crypto recovery. Whether it’s a cold wallet or a hot wallet, our services are efficient and affordable. Contact Us to get started today.

Frequently Asked Questions

How do I ensure a secure transfer?

Verify both sending and receiving addresses carefully, use test transfers for larger amounts, and confirm that you’re selecting the correct network. Double-check all details before finalizing the transaction.

What network risks should I be aware of?

Transferring tokens on the wrong blockchain can result in the loss of funds. Confirm that the destination wallet supports the token’s network (e.g., ERC-20 on Ethereum) before sending.

Why use hardware (cold) wallets for transfers?

Hardware wallets store keys offline, reducing exposure to online attacks during transactions. Always follow the manufacturer’s instructions to safely connect and sign transfers when moving funds.

What extra precautions are needed for exchange transfers?

Exchange wallets are custodial, meaning you rely on the platform’s security. Use features like two-factor authentication, and verify withdrawal addresses from your account settings to avoid mix-ups.

How can high network fees impact transfers?

Setting a fee too low may delay or cancel your transfer during network congestion. Monitor current fee trends and adjust your transaction fee accordingly to ensure a smooth, timely transfer.